FAQ

Do you need help navigating our website? The most frequently asked questions and their answers are provided here. Check out the topics in the left column or use the drop-down menu below.

Feel free to use our AI-trained ChatBots: Mercator & Ortelius

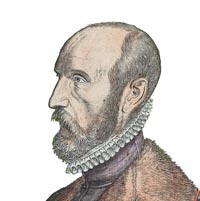

Mercator ChatBot

Our AI-trained chatbot, Mercator, is designed to provide you with answers about purchasing at the Paulus Swaen site.

Mercator can tell you about shipping, invoicing, terms and conditions and where to find your invoice. We also offer Live Chat Support during business hours.